For generations, people of color have endured economic inequality, a reality that has gained renewed attention amid the recent Black Lives Matter protests.

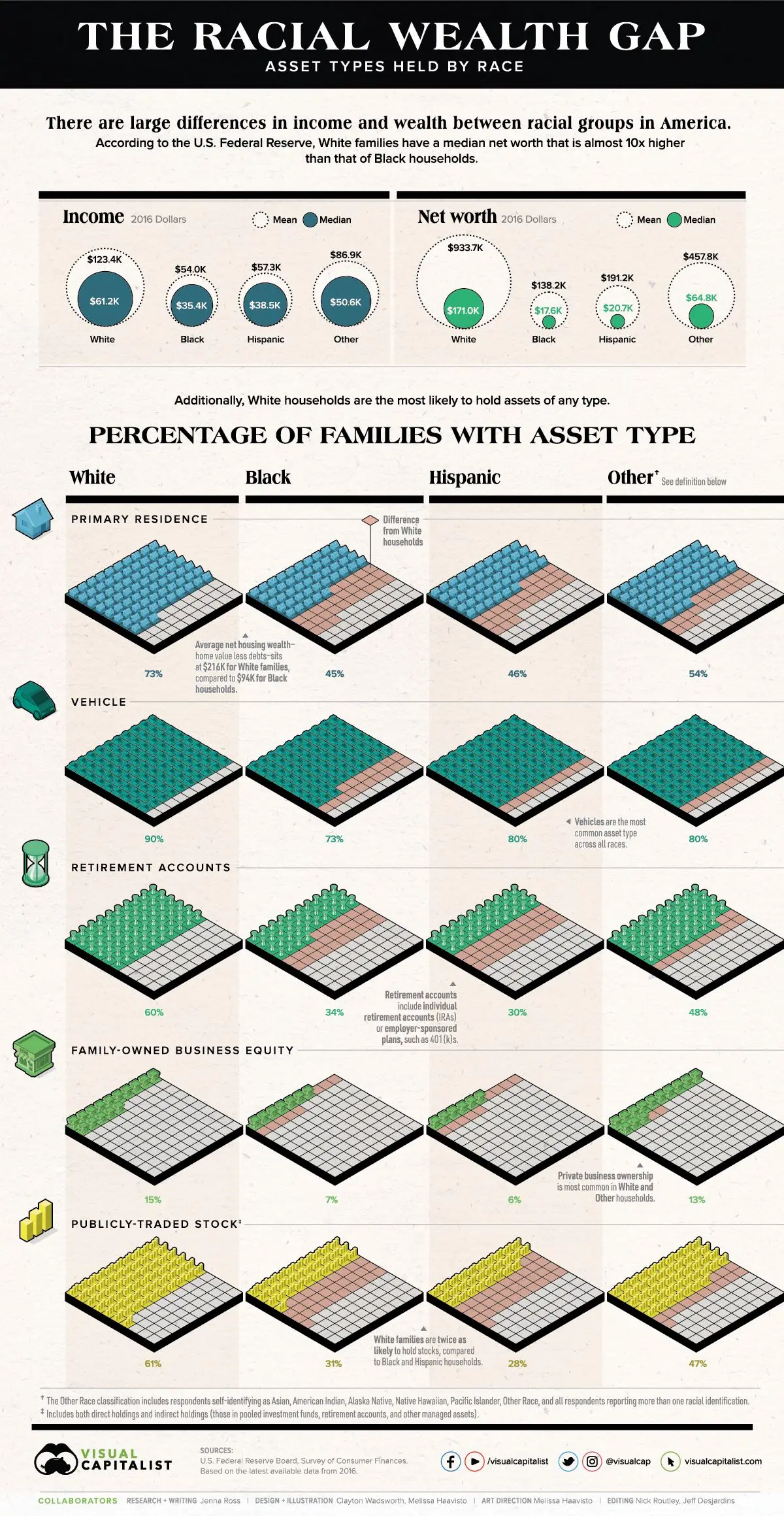

When comparing racial groups, families of color generally have lower income and net worth levels. Notably, 19% of Black families possess zero or negative net worth, contrasted with only 9% of White households lacking wealth.

Recent data from the U.S. Federal Reserve’s Survey of Consumer Finances illustrates the racial wealth gap and asset ownership across different racial groups. Vehicles are the most commonly owned asset, followed by primary residences.

However, equity in homes varies significantly by race: White families hold $215,800 in home equity, whereas Black and Hispanic households have $94,400 and $129,800, respectively.

Moreover, White households are more likely to own financial assets like retirement accounts, stocks, and family businesses, which are crucial for wealth-building and often lead to higher average returns through the power of compound interest.

A recent study by the Federal Reserve Bank of Cleveland emphasizes that income inequality is the primary driver of the racial wealth gap. If Black and White households had equal earnings since 1962, the Black-to-White wealth ratio could have reached 0.9 by 2007. The study advocates for policy changes to combat income disparities and racial discrimination in the labor market.